Financial Literacy

Special | 26m 46sVideo has Closed Captions

This episode will examine programs and classes designed to teach students basic budgeting.

This episode will examine programs and classes designed to teach students basic budgeting, saving, and other money management skills they will need to achieve financial independence.

Carolina Classrooms is a local public television program presented by SCETV

Support for this program is provided by The ETV Endowment of South Carolina.

Financial Literacy

Special | 26m 46sVideo has Closed Captions

This episode will examine programs and classes designed to teach students basic budgeting, saving, and other money management skills they will need to achieve financial independence.

How to Watch Carolina Classrooms

Carolina Classrooms is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

More from This Collection

Video has Closed Captions

Learn about the work of student journalists and content creators. (26m 46s)

Video has Closed Captions

This is an updated version of our March 2023 episode. (26m 46s)

Video has Closed Captions

This episode will explore ways to combat summer learning loss. (26m 46s)

Video has Closed Captions

We’ll share the work of student journalists and content creators. (26m 46s)

Video has Closed Captions

Exploring workforce development opportunities in South Carolina. (26m 46s)

Video has Closed Captions

Families share their experiences with the programs and services of First Five SC. (26m 46s)

People First: Special Education Programs

Video has Closed Captions

This episode will explore special education programs, resources and services. (26m 46s)

Carolina Classrooms: Applying for College

Video has Closed Captions

College admissions professionals discuss how students can plan for and apply to college. (56m 46s)

Carolina Classrooms: Making College Affordable 2018

Video has Closed Captions

Carolina Classrooms: Making College Affordable 2018. (56m 46s)

Carolina Classrooms: Digital Literacy

Video has Closed Captions

A discussion on how digital media literacy skills are being taught in South Carolina. (26m 46s)

Carolina Classrooms: Summer STEAM

Video has Closed Captions

Keep learning and avoid the Summer Slide. Solar Eclipse preview. (26m 46s)

Carolina Classrooms: School Choices

Video has Closed Captions

Education options for South Carolina students. (27m 46s)

♪ <Host> Hi, welcome to Carolina Classrooms.

I'm Laura Ybarra.

Learning how to manage money is an important life skill.

For younger students financial literacy means identifying different types of money, understanding the value of different coins and paper money.

As they get older, they learn about budgeting their needs versus wants, and then how to plan and save for something like a car or a college education.

Managing personal finances or making business decisions for a corporate budget, opening a savings account for the first time, or saving for something big like a college education, Financial literacy skills can mean the difference between success and filing for bankruptcy.

On this episode of Carolina Classrooms we'll examine programs and classes designed to teach students of all ages basic budgeting, saving and other money management skills they will need to achieve financial independence.

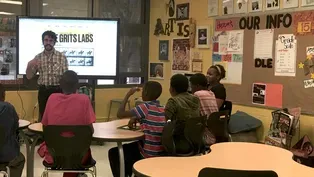

Students at Elloree Elementary School in Orangeburg County are participating in the stock market game, competing against other schools in South Carolina.

Their teacher says while they are learning about economics, the teamwork skills they're building are just as important.

<Treyvon> We see like one of our stocks not doing good.

We decide whether we should keep it or sell it.

<Russell> Today, me and my team, we were looking at our stocks and all of our shares in the stock market game, and we were seeing if we were going to invest or sell any of our stocks, and we were just looking at all the stocks to see what we want to really invest in.

<Malachi> Well, competing in the stock market game, me and my friends, we competed, and we don't have any experience with stocks before this.

This has been an incredible experience to learn.

We're at 49,275.

<Sharon> The stock market game is actually nationwide, but we have South Carolina's version of it, where they compete against schools all over the South, all over South Carolina, excuse me.

And they try to buy and sell stock, of course, and make a profit.

And so the team that makes a profit at the end of the term, which is April 15, which is around tax day, then they get to go to a big function, and they get all the bragging rights for that year.

So it teaches them about investing, and a lot of adults don't even know about the stock market.

So they're getting an opportunity that many adults may not get to have.

They have the action, they start off with $100,000, and they have to purchase a minimum of 10 shares of a particular company.

And then they decide whether they want to keep it or sell it if it's doing well.

If it's doing poorly, then they'll sell it.

<Treyvon> Everything is getting affected by the conflict between Russia, so we have to make wise decisions.

We learned about how stocks, they go up and how do they go down, and what should we invest in, what should we not invest in.

<Sharon> Financial literacy is making smart financial decisions, being knowledgeable about banking, saving, investing, and money for college it's being able to manage your finances effectively in order to be productive.

I teach all the way from kindergarten to eighth grade.

For my elementary, for kindergarten and first grade, we learn, you know, what the value of like a quarter is and pennies, and I start with that.

For third through sixth, there is actually a financial literacy simulation called Vault.

It is through EVERFI.

And so I make sure that the students do that exercise, and I'm there as an assistant, you know, to facilitate them getting through that, and it teaches the basics of what a budget is, what is saving, different types of banks and that kind of thing.

And then for middle school, seventh and eighth grade, they do a program called Future Smart and it's funded by Mass Mutual and they actually get a financial literacy certification.

And then I have my eighth grade team doing the stock market game.

<Treyvon> We've learned about successful budgeting and saving and spending what you need to spend.

<Malachi> It showed me responsible decisions about what's neat.

<Sharon> It's important that they have the skills at an early age so that when they get older they can make smarter financial decisions.

I have experienced that myself.

When you get to college, they're going to throw different credit card offers at you, and you need to be able to decide whether that is a good idea or not.

<Treyvon> We see like one of our stocks not doing good, we decide whether we should keep it or sell it.

<Malachi> It's a group effort.

<Sharon> So how do you, when you reach a disagreement, how do you work that out?

Because I'm sure you've come across some where... <Treyvon> We've had plenty.

<Russell> We usually just do like a majority vote.

<Treyvon> Yeah, majority vote.

So right now, I think we're doing pretty good.

<Russell> We really work like side by side, we have really good teamwork.

We don't make any decisions unless we all agree upon it.

So we, we have to have good teamwork to get those done.

<Sharon> Soft skills are so important.

I'm in Career and Technology Education.

So I get to see what the industry is looking for.

And I've heard many employers say, yeah, they can do the skill work of the job, but their social skills leave a lot to be desired.

So anything that... so anything that can produce good teamwork, being on time, time management, making smart decisions, your attitude.

Those are the most important things because you can be skilled at whatever you do, but if you can't work with your teammates, then you're useless.

So those are the things that they learn.

You hear my students say that they don't buy or sell without the consensus of everyone.

And so that was the base.

They started that from the beginning.

I didn't have to tell them that, that each person is important in the group.

There's not one person that makes a decision by themselves, and you find that in the workforce.

So if you have to work with a team, and sure, you may know everything, but everybody brings something different to the table, and we have to appreciate the diversity.

<Laura> Students in grades 4 through 12 can participate in the stock market game.

Competitions like this get students excited about the content and increase their retention of the concepts they're learning.

At Central High School in Chesterfield County, Darron Kirkley teaches his students about financial literacy with hands on career focused examples.

<Conner> This year in this class, I've been doing the work base class, which is where I create posts for the Discover Chesterfield County Facebook page, and I'll work with Mr. Kirkley on that, and we'll get together some ideas.

I'll put together the posts, and then we put it out whenever we think would be best.

<Darron> I served as our tourism director here for this county that we're in, which is a part time role, because again, tourism is not our number one product in this county, but, so I do that, and then I'm able to bring those real life experiences and of what we do with our money, finance, budget, all that, grant programs, I oversee all of our grant monies here.

So I can bring in those work based learning students, teach them that, and then show them real life that even here, this is an important industry and how they can make applicable to their lives.

Financial literacy is truly having an understanding of your money and your personal finance and how that's going to work and then seeing how your money that you have yourself plays into the overall ecosystem, the economy of finance in general, right, and having an understanding of what role the individual plays in the overall society's role and how taxes, stocks, bonds, all that stuff interacts with one another.

We offer four different courses and then a work based component as well.

But our four courses are Intro to Hospitality and Tourism Management, Lodging Management, Event and Entertainment Management, and Travel and Tourism Management.

So they all fall within the hospitality and tourism cluster, but they focus on different segments within the industry.

So depending on what course the kids take depends on what they're exposed to and what they learn about.

Obviously, in lodging, the focus is on types of lodging, hotels, motels, B&B's, and even Airbnb's.

We'll even get into the home sharing aspect, things of that nature.

Then on the event and entertainment side, we'll do everything from planning an event such as a wedding or a corporate event at a hotel, all the way to planning your own festival from A to Z.

<Conner> The most interesting thing I've learned in here definitely has to be what it takes to run and manage an event.

I remember when I was assigned it, we got to choose what type of event we wanted.

I went with a music festival.

So I had to pick the artists I wanted to be there.

I had to get sponsors.

I had to set up booth sizes.

I had to get power and water setup.

It really helps you to understand finance.

It teaches students a lot, because in here you can get assignments for running your own event, from marketing it to setting up sponsorship deals, to even just making sure you have all the equipment like port-o-johns, lighting, sound, all that stuff.

<Darron> Every class I teach has some kind of hands on component, everything from, like I said, plan your own event, where you would have to lay out the entire budget for the event, everything you're going to book, entertainment, venues, food and beverage costs, all that, all the way to...

In the travel class, there's like their own travel agent for someone and be given a budget of how much money they're going to spend, and look at that aspect of the cost of travel both domestically and internationally.

<Abby> Like just traveling, like where you're going to stay at, like how you're going to travel whether it's like air, rail, coach, anything like that.

If you're... especially if you're like a travel agent, and you plan that for somebody, you need to take their budget into account.

And even if you're just planning to travel yourself, you really need to take into account your budget and what you're going to spend and everything like that.

<Ayden> You have to like put hands on and everything because other people just don't know what TSA will go through, what you need to travel, like what you need to carry after you'd like get your flights, your hotels, for like any other things you want to do besides that.

<Darron> In the intro class, they actually build their own restaurant.

So that's where we cover a lot of the food and beverage aspect of it.

So they'll have to do everything from menu design to pitch a location, by looking through like a market analysis of where it's best to locate that business and then justify why they chose that and things of that nature.

<Ayden> People will come from different other states.

Like Myrtle Beach, for example, it will come like summertime, generate a lot of money, half of the people be like tourists, just come and drop by, that's like a lot of money due to them just even stopping by spending money at a gas station just getting money, or just like buying food, chips, and stuff like that.

So basically all that money, just revenue generates like more air conditioning, we can just make more things come throughout the whole entire progress with it.

<Darron> On the Travel and Tourism side, it's everything related, just like it says, to travel and tourism.

So we'll cover everything from airlines to cruise ships, to international travel, a lot of things a lot of students at this age are not exposed to.

So just a lot of the aspects of travel and tourism and promoting a destination or getting visitors to come to an area.

<Abby> Definitely learn about cruise ships.

You know, you just think about like a boat, you don't think about what all necessarily goes into it, like the planning, especially if it's like themed, they have a lot of staff, like way more than I'd imagine.

And with that, there's different contracts and things.

And I was very surprised to learn about what all they had to do just to make it function.

You know, some of them, you sign for like extended amounts of time to stay on the boat and things like that, just like the hours.

<Darron> These students are taught things all the way from the lower level of the individual side of it.

They're given that hands on experience with their own budget, their own finance, their own money.

Some of the activities they're given, you know, a set dollar amount that they have to stay within, but then we can go larger level, larger economy size, and look at the impact that travel and tourism has on the overall economy here in South Carolina, like being the number one industry.

You know, when COVID happened, obviously that had big impacts on our industry and how that affected it.

So we had those discussions about taxes and revenue and how people lost jobs and how, how the industry bounced back, but how the way we bounced back wasn't necessarily sustainable, and how, you know, the $15 to $20 hour for a frontline employee sounds great, but is that sustainable long term for the economy and things of that nature, so I think it's really given them opportunities to see that and to interact from the personal level all the way up to big scale.

<Abby> Having these things in classes you get to learn about like the hotel management.

You get to learn about the different classes that are taught.

You get to have those experiences from a person who's actually done it and knows what they're talking about and teaching.

So when you do graduate and like go to university or anything like that, you have an idea of what they're talking about, and you have more experience than you would have if you hadn't taken any of the classes.

<Ayden> Tourism and Hospitality will be a good good energy to look into.

Got to be smart with it, though, like financially wise, like just, it's really basically common sense how you spend, how you really should regulate your money.

<Conner> Taking these classes has definitely changed the way that I view managing my money because when I was younger, I used to not look at it as much of a big deal.

But now that I'm older, I see how much money plays a role in everything.

And I'm more than likely going to start investing or saving my money now.

<Darron> Each course within our curriculum, I find some way of intertwining, the personal relationship to that.

And so it'll be anything from the discussion of the stocks or the taxes that individuals pay when they go out to restaurants.

Taxes obviously play a big role in finance in general, and understanding how that works and understanding, like when you're a 1099 employee and things of that, the kids necessarily don't even know what that means, but how you're going to have to pay taxes out of that when you do freelance work.

And we talk about influencers, travel bloggers, all that kind of stuff, and how that is great revenue stream, but then you have to pay taxes on it if you're running your own business, and all that kind of stuff.

So across the board, whether it's run your own restaurant scenario, plan your own festival, look at these stocks and bonds.

Let's talk about a travel blogger that a Convention and Visitor's Bureau may bring in to their destination.

We go into those discussions about, you know, how those taxes go into it, how you have to, yeah, you got that $10,000 check, but you're gonna have to pay the tax on that $10,000 at the end of the year, and how to financially be ready for that.

And so it's, you know, a great way for them to give them real life examples of something they may be interested in doing, being a wedding planner, but whether the implications are long term for that for career and financial growth and all that.

<Laura> SC Economics provides resources and professional development opportunities for teachers who want to incorporate financial literacy into their curriculum, no matter what grade level or subject they teach.

<Chandler> SC Economics is a nonprofit organization housed in Columbia, but we serve the entire state, K through 12 educators.

Our mission is to teach teachers how to teach economics and personal finance, through our workshops, webinars, resources, and coaching that I get to do with teachers one on one.

This professional development helps teachers strengthen their content knowledge, or new teachers to learn that basic content knowledge so that they feel comfortable and able to teach it to students across the state.

We had one of our in person workshops.

We're really excited to bring those back for 2022.

And so the economics workshop was called Economics Everywhere, and it featured ways to incorporate economics in all different subjects.

And so we looked at how to incorporate economics in English, math, elective science, social studies, and that included portions of personal finance, especially in the math part, but also personal finance can be woven throughout as well.

<Denise> We are here for professional development, South Carolina.

SC Economics puts it on for the master financial literacy teachers and others that may be interested in it, and it's to help us incorporate financial literacy across the curriculums.

<Chandler> We've got kindergarten all the way through high school with us here today, but I will tell you, I have a high school background, Meghan has an elementary and middle school background, we can make all of these things work.

And I will tell you, we're going to do some children's literature today.

I used to make my 17 and 18 year old high school seniors come sit in a reading circle with me.

So all of these things can very much be transposed from either grade level, and hopefully you guys will see in all subjects.

<Desiree> I've been hearing today, and we've been working with interactive activities, most of those where I can not only incorporate financial literacy, but I can also allow the students to play and have lots of fun as we learn.

<Amanda> I teach at Lonnie B. Nelson.

I teach in the ACE magnet program and I teach kindergarten.

Our program ACE is the Academy for Civic Engagement, and we focus on government, economics, and service learning.

So economics is a big piece of our classroom.

Our kids have jobs, which they earn an income.

They pay bills.

It's a little less, you know, aggressive in terms of like what they pay for kindergarten, because we are just starting them out.

They purchase their supplies, so we give them like their allotment.

But if they waste their glue, they have to buy another one, and so we teach them those things.

And so we talk about really focusing on like saving and spending and those things and talking about wants and needs.

So one of the things, especially in kindergarten, a lot of them don't have a lot of experience with money.

And so we talk about like, okay, if you spend all your money on this little trinket from the store, you're not going to have money if you don't have a glue stick.

So we've had to kind of adjust and talk about loans, because some of them like they need the glue stick.

So we've had to say, "Oh, you had to take out a loan this week, so you're not going to get to go shopping, because you have these expenses."

And so we kind of have had to talk about some of those things, because they don't really understand living expenses, and things like that.

So it's kind of like really putting that real life experience in the classroom.

So I came to get ideas and strategies to take back and work further in the economics piece for my kids.

I've been learning all kinds of different like games and ways to integrate especially those terms like producer and consumer because some of those things are really hard for kids to understand.

And it's hard for them to even put like they don't spend a lot of their money.

They don't see a lot of that real world.

You know, and they might think about saving for something, but for a lot of kids it just shows up, like I just want this and it comes.

And so we played a game where we were talking about the, you know, when we were saving for something and rolling the dice to kind of catch up and then thinking about to like real life things, like that money doesn't just pour in.

You have to understand that things happen, and sometimes you don't get the money or you have to spend it on something else.

And even some of those things like opportunity, costs, and things like that, like really helping the kids understand, like, when you have money, like that gives you the power to decide like, which product are you going to purchase?

And then what are you giving up?

And so we've also done some things like with products, and talking about consumers and producers.

And so we can tie that in, like I said, with my market day, and, so I'm just excited to take some of these things back to my classroom and really help, especially a lot of it, you know, it is so versatile, like you can use it in high school or even in kindergarten.

<Denise> Our students are not prepared financially.

They don't have the skills, they don't have the mindset, the behavioral mindset to be able to be successful financially.

They're getting into debt, they're falling into payday loans.

So the goal in that aspect is to give them that security and confidence so that they can focus on their future and not how am I going to pay this bill.

They're going to be able to say, "I can pay this bill," and continue to be successful on a personal level as well beyond and focus on other things that they need to focus on.

So for the students, I do a multi level approach.

I work very hard to not only connect it to them currently to their academics, but also future.

So we also do real world and academics.

So we discuss how ratios plays into financial literacy, how analyzing and understanding evidence and text incorporates into financial literacy.

So a lot of cross curricular incorporation there as well to build that value and purpose.

And then we relate it to the real world, because many of them, they might want to go to college or they're looking to have a car or jobs.

So we bring those real world in so that as they move forward into high school, they're prepared and they can start thinking about what a budget is and what insurance is, and be more prepared as they move forward.

<Ed> South Carolina Economics has helped with so many resources.

The webinars, these in person events, are just great to get with other teachers and find out what they're doing in their classes and take ideas from other people and apply it in my class, and that's one of the best things I get out of it is just the camaraderie and the chance to talk to other teachers that teach the same subject.

<Tamikah> I'm with Palmetto Unified School District, which is within the South Carolina Department of Corrections.

I teach mathematics and financial literacy.

Oh, extremely important, especially for my students who are, they're in a reentry facility, so they'll be returning into society soon.

So it's equipping students in general, especially mine, to be financially literate, so they can function in society and make wiser decisions as it pertains to finances, their family, and being able to sustain themselves, as well as creating generational wealth.

So I'm in Manning High School, again.

It's within Department of Corrections.

And in this setting, our students are preparing to return to their homes, and so the challenges and barriers they face are enormous.

In terms of the amount of time they've been incarcerated, it ranges from, let's say, 20 to 25 years to possibly 2 to 3 years.

So it's a range.

So they are faced with many barriers to include identity theft, for example.

Some of them may have experienced that, while being incarcerated and not being financially literate, in terms of knowing how to protect themselves, even in that environment.

For example, they could have put a freeze on their credit while they were incarcerated, things like that.

So those are some of the things that we discuss, and discuss them requesting the credit report even while they're incarcerated.

So before they're released, they can kind of, you know, try to get some things back on track, if necessary, or they can identify if they were, in fact, taken, you know, were victims of identity theft.

That's just one thing that really stands out in that environment, but preparing them and teaching them how to budget, how to save.

Um, some of them actually do have jobs while they're in our facility or they are preparing and set up, you know, to start working when they leave, so teaching them how to manage their money wisely.

Some of them will have to pay fines and so forth when they leave.

So teach them how to manage and balance that along with the necessities that they need in life.

So budgeting, saving, helping them plan for transportation costs and other things is essential to their survival.

It definitely helps with our recidivism rate, preparing them and equipping them with the knowledge that they need to be successful when they return to society.

<Chandler> We hear all the time from our local community partners with banks and statewide, that they often have customers who come to them and don't have those basic skills of understanding the importance of having not only a checking account, but also a savings account, and not accessing that savings account constantly, but having that as an emergency fund.

And so helping us build that community of understanding the importance of emergency funds and the importance of savings and why we always save for that rainy day because it can so often happen, but the ability to have that kind of safety net and that concept of that safety net instilled in our students as early as possible can only have success for our communities in the future.

<Tamikah> Teaching financial literacy is more of a life skill, because this is a skill that they will need to be successful.

<Laura> Professional development events like this allow teachers to discuss and collaborate on ideas for lessons with other teachers from other districts.

For more information, visit their website sceconomics.org.

Thanks for joining us.

We'll be back on TV in April.

You can find more education stories from around the state on our website, CarolinaClassrooms.org

Carolina Classrooms is a local public television program presented by SCETV

Support for this program is provided by The ETV Endowment of South Carolina.